With tighter prudential lending rules, people wishing to get onto the property ladder may find it harder than it was 12 months ago. (They might also find the high property prices in most Australian states a barrier, too.)

But a number of new fractional investment platforms aim to make it easier for investors to start a property portfolio and these options are available through an Australian company that’s listed on the ASX!

DomaCom, a fractional property investment platform traded on the Australian Securities Exchange (ASX) as DCL, allows property investors to pool their funds together to purchase properties. The platform has partnered with developers and also pulls — through an API — property listings and market data from property site Domain.

Invest in property for as little as $2.5k

Investors can either search for a property to invest in or join an existing investment campaign, contributing funds of as little as $2,500. (While anyone can be a DomaCom investor, the platform is specifically targeting the SMSF (self-managed super funds) market.) Once enough investors have committed to the property, it is purchased by DomaCom — which carries out the necessary due diligence (conveyancing, valuation, property inspection, etc) — and operates as a “Managed Investment Scheme” (MIS).

Melbourne Securities Corporation are the trustees of the DomaCom fund — the MIS that allows investors to select the properties of their choice — while Perpetual Corporate Trust holds the title for each property.

By pulling listings and data from Domain, the platform makes it easier for buyers to co-invest with friends and relatives in a property they may actually like to live in. However, there’s a catch: Once the property has been purchased DomaCom appoints a property management company to oversee the tenanting process. The platform says that even though investors will be given some preference over other applicants, “there are no guarantees” and ultimately, the best tenant for the property will be selected.

Trade property “shares” like on the ASX

Properties purchased through DomaCom must be held for a minimum of five years before they can be sold, at which point each investor will share in the sale price of the property proportional to their shareholding.

For investors who have no emotional attachment to the properties they invest in — i.e., they’re not looking to one day reside in them — DomaCom also has a liquidity facility, that allows investors sell their shares in properties to other investors, like they would on the stock market. DomaCom charges a 0.88 percent annual management fee.

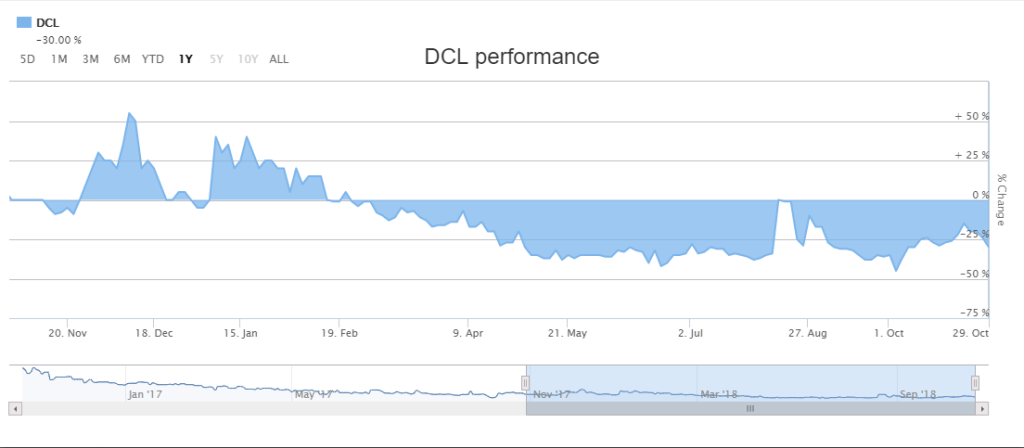

ASX investors aren’t sold on DomaCom

It’s worthwhile noting that DomaCom is still in its nascent stages, and as a potential investment for stock market investors they’re not quite sold. It’s currently trading at just 7.3 cents on the ASX, with a market cap of $7.9 million. In the 12 months to June 30 this year, it generated $143,000 in revenue — an increase of 54 percent year-on-year — and posted losses of $5.7 million — down 8 percent YoY; an improvement at least, but it still has a long way to go.

Since the platform launched in 2015, it’s closed just 54 deals and invested $37 million into property. In February, property research group SQM Research downgraded its investment rating by a quarter of star to a 3.5 star rating.

In a note to clients, SQM said it was “concerned about the ongoing viability of DomaCom given the inability to demonstrate any steep increases in funds under management in recent years,” according to the Australian Financial Review.

However, DomaCom chief executive Arthur Naoumidis remains bullish, pointing to the 54 properties it’s invested in — far more than rival BrickX — and the $100 million private lending line it secured in June to use towards the acquisition of $250 million worth of property.

If you want to invest in affordable properties in the Central Coast to Port Stephens regions, inquire with us and let us know what you’re looking for.